INTRODUCTION

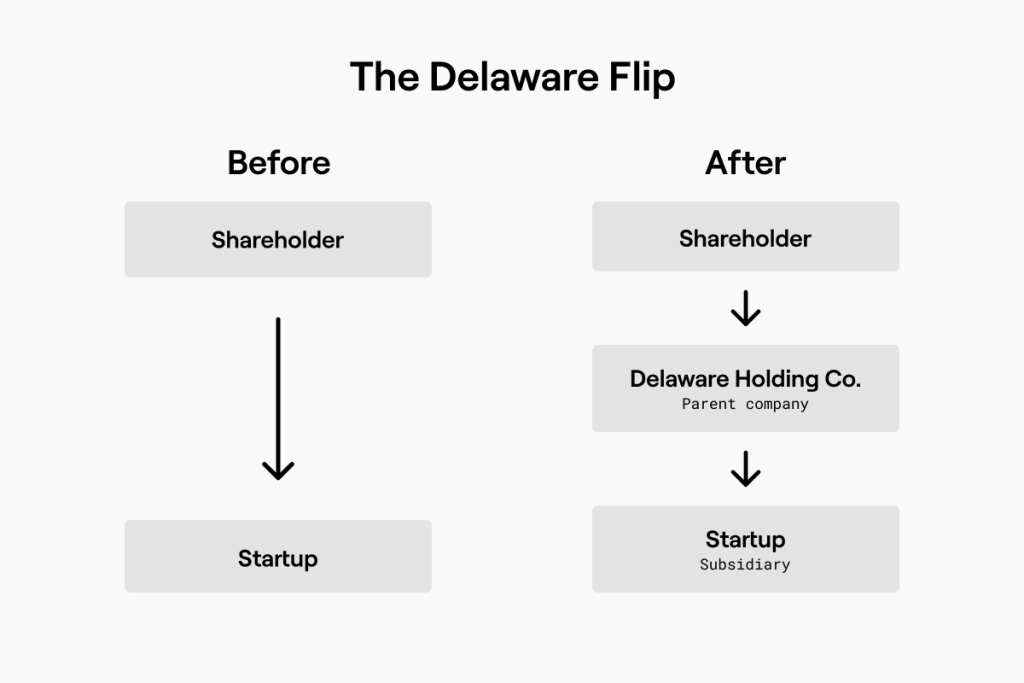

Why do Flutterwave, Paga, Paystack, Kuda, Cowrywise, Andela, Ulesson, Shuttlers and a host of others have their Parent/Holding Company in Delaware, United States?

Interestingly, over 70% of StartUps that are incorporated outside Africa are based in Delaware, United States (Disrupt Africa).

According to Forbes Advisor, Delaware has become internationally recognized as a corporate paradise and is “home” to such famous firms as Amazon, Google, Tesla, Walmart, American Express and Disney, to name just a few. Interestingly, 68% of Fortune 500 companies and 93% of all U.S.-based initial public offerings are registered in Delaware United States.

So, what is the fuss about Delaware, United States?

1. CONDITION PRECEDENT TO FUNDING: To get funded, most Venture Capital (VC) requires your Company to be incorporated outside Nigeria, and form a Holding-Subsidiary Relationship, the Delaware Company becomes the Holding Company and the Nigeria Company a subsidiary.

Here is an extract from Y Combinator FAQ Page

What if we incorporated as a non-US corporation?

If your company is already incorporated somewhere other than the United States, Canada, Singapore or the Cayman Islands, in order to participate in YC you will need to create a parent company that is in one of those jurisdictions. The existing company will then become a subsidiary of the new United States, Canada, Singapore or Cayman parent company.

2. FUNDING OPPORTUNITIES

Undoubtedly, the US has the biggest funding institution, with $63 billion in 2022 and positioning is synonymous with funding. So, asides from being a condition precedent, the need to attract investors and VC firms will drive StartUps to incorporate in the US and perhaps Delaware.

3. TAX BENEFITS

According to Forbes Advisor, the most famous reason Delaware has attracted the eye of corporations across the world is the lenient taxes imposed by the state. Corporations registered in Delaware that do not do business in the state do not pay corporate income tax. Delaware also does not have a sales tax, investment income taxes, inheritance taxes or personal property taxes. While companies do have to pay a franchise tax to register in Delaware, this can be pennies compared to the income tax other states would charge. Nationwide companies that do conduct business in Delaware can still skirt the in-state income tax by establishing subsidiary or shell companies that hold various intangible assets but do not directly run business operations.

4. CORPORATION COURT

Instead of a traditional trial system, corporate lawsuits in Delaware are resolved by the Court of Chancery, a court made up of judges who specialize in corporate law. Because of this, Delaware has well-developed and predictable legal precedents that may benefit corporations. While the average civil lawsuit may take a number of years to resolve, Delaware’s use of judges instead of juries and prioritization of corporate-related cases means similar cases can be decided more quickly.

5. PRIVACY

As with registering a business in most states, companies must assign a registered agent who maintains a physical address to be the official address and to receive mail and collect paperwork. Unlike most states, however, in Delaware, the registered agent is the only name that must be disclosed in association with the company. Other officers and directors are not required to disclose their names, allowing an extra degree of anonymity. Because of this lack of reporting, officers, directors and shareholders are also not required to maintain residency in Delaware.

For Delaware Company Formation and how to form the Holding-Subsidiary structure between the Delaware Company and the Nigeria Startup, feel free to contact us.

Tolulope Oguntade

Regville Associates

info@regville.com

08065111667