According to the law in Nigeria, the Companies and Allied Matters Act 2020 and the pharmacy Council of Nigeria have paved the way for incorporating a pharmaceutical company. As a result, this encourages everyone with their field of specialization to own a pharmaceutical company and also invest in it.

Note that one of the fastest-growing and most lucrative industries in Nigeria is the pharmaceutical industry. The registration of pharmaceutical companies in Nigeria is carried out and supervised by The Pharmacy Council of Nigeria (PCN) a statutory organ of the Federal Government of Nigeria, set up pursuant to decree 91 of 1992

What is a pharmaceutical Company?

A pharmaceutical company produces the likes of markets and acts as a medical drug distributor to patients to cure, vaccinate, or even alleviate their symptoms. So if you plan to establish a pharmaceutical company in Nigeria, this article is for you.

Based on how this article is detailed, you will learn how to set up a pharmaceutical company, the kinds of persons that are eligible to set up pharmaceutical companies, the registration requirements, and also the stated procedures to be followed to obtain the license to set up and run the business.

However, the Pharmacy Council of Nigeria (PCN) serves as a self-regulatory organization that plays a crucial role in regulating, licensing, operations, and monitoring pharmaceutical businesses in Nigeria.

Procedure to Register a Pharmaceutical company in Nigeria

The first thing about registering a pharmaceutical company is that it can either be registered as a private limited company or a public limited company. However, the preferred choice made by most medical experts is to register as a private limited company.

Additionally, the categories of pharmaceutical companies that can be registered in Nigeria are three. They include; pharmaceutical retail, wholesale, and manufacturing.

Requirements for Registration

Pharmaceutical Retail Company

What a retail pharmaceutical company does is sell drugs to people. They are usually known as a pharmacy, chemists, or drugstores. For a retail, pharmaceutical company to function, it must be fully owned by a registered pharmacist or must be in partnership with other registered pharmacists.

A wholesale pharmaceutical company

The job of this kind of company is to import and distribute drugs, poisons, and devices. For this kind of company to operate, it requires at least one registered pharmacist on the Board of Directors of the Company. However, the transactions of the business must be executed under the direct personal control and management of a Superintendent Pharmacist.

A pharmaceutical manufacturing company

The pharmaceutical manufacturing industry works on the manufacturing of drugs. To register this kind of business, there must also be at least one registered pharmacist on the Board of Directors of the company. Additionally, the business operation must be done under a Superintendent pharmacist’s direct personal control and management.

Step 1: Company Registration

As mentioned before, most medical personnel prefer to register as a private limited company. Therefore, it is advisable also to do so. The reason why a private limited company is the most preferred choice for a business start-up is that there is ease of registration when it comes to costs and requirements. As for share capital, there is no specific threshold amount. Nevertheless, the company can also be registered with one million share capital.

2. Application for Inspection of Premises

Registering your pharmaceutical company will be one of many things you should do. You also have to take some necessary steps to obtain the business license, which comes after the scrutinization and approval of the business premises to be used.

In Essence, the pharmaceutical inspectors from the PCN would inspect your business premises for the purpose of ensuring that your business operation is in compliance with the provision of the regulation. This will be done before your pharmaceutical business will finally commence.

When it comes to the law, there are some ethics to follow, and the law on the inspection of the premises of pharmaceutical companies must be followed. The following guideline will be stated below.

- The pharmaceutical premises must be located in specific locations like; motor parks and environments where commercial activities and enterprises are rapidly growing.

- It must be outside a marketplace where the likes of kiosks and roadside retail are present.

- All pharmaceutical premises should be at most three within a shopping mall, and there must be enough space between both businesses.

- Pharmaceutical businesses should be at most two hundred meters away from each other.

- The pharmaceutical business should be moved to another location if it is surrounded by a growing market close to it.

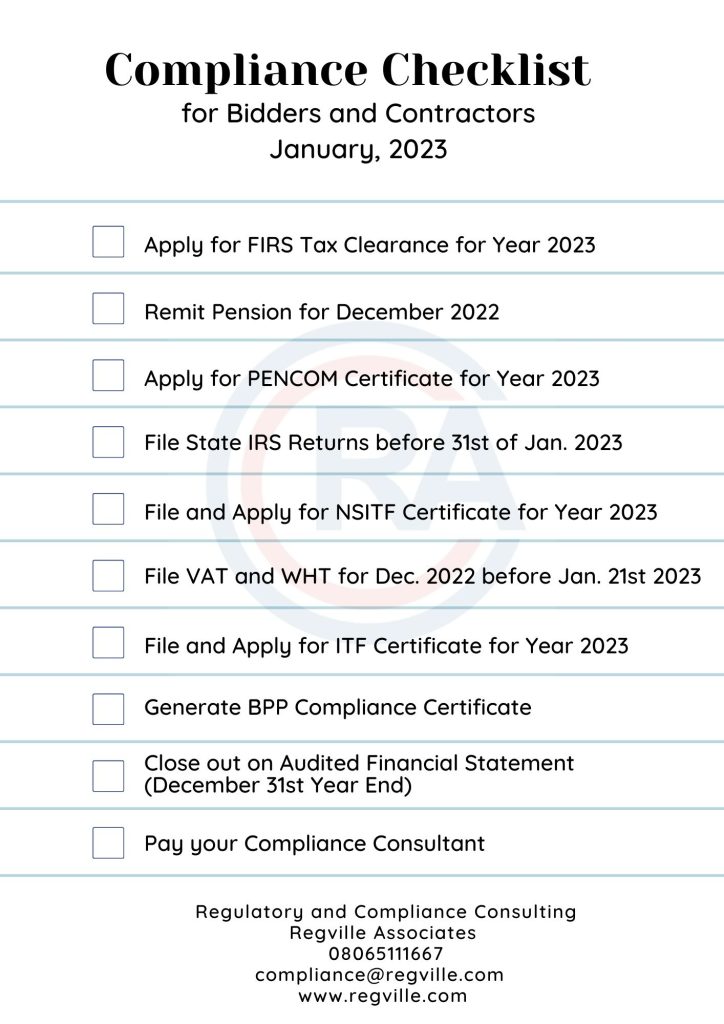

Required Details to Register a Pharmaceutical Retail, Wholesale, or Distribution Company

Note that all applications for the registration of new pharmaceutical retail or any other related business should be submitted to the Registrar of the Council through the Director of Pharmaceutical Services of the state of operation. Below are the following documents to be submitted as application documents.

- An application letter (the company’s letter headed paper) to the recipient

- A Duly completed form which includes (PCN’s Application Form for the Registration of Premises)

- A photocopy of the Annual License must be provided

- A bank draft that contains the prescribed inspection and registration fees, which is payable to the council

- Copy of a letter of resignation from previous employment (if necessary)

- Letter of acceptance of resignation (if necessary)

- Letter of Appointment in the new premises (where applicable)

- There must be a legal agreement between the Superintendent Pharmacist and his employer.

- Must provide the company’s certificate of Incorporation (this involves evidence of registration of the business name, which is acceptable as regards Pharmacist-owned retail premises)

- Must provide a certified copy of the company’s Articles and Memorandum of Association

- Certified copy of Particulars of the company’s Directors as issued by the Corporate Affairs Commission.

- A copy of the NYSC Discharge or Exemption Certificate (if necessary)

- Must provide a letter of undertaking signed by the Managing Director of the company that all pharmaceutical businesses would be under the direct, personal, control and management of the Superintendent of the Pharmacist

- A pharmacist Inter-state Movement form (if necessary)

- Evidence of a pharmacist on the Board of Directors and the current Annual License of the pharmaceutical Director

Additional requirements for the registration of pharmaceutical manufacturing premises

The likes of the pharmaceutical retail, wholesale, distribution, and importation have the same process as a pharmaceutical manufacturing company. It is, therefore important to note that as far as a pharmaceutical company is concerned, there are certain procedures to follow during the course of registration. Below are the requirements every pharmaceutical manufacturing company is expected to make available to the council.

- Accurate product lists to be manufactured.;

- An Organogram;

- List of staff qualifications and duties;

- Factory layout;

- Production flow-chart;

- Equipment list in the production and quality control departments;

- Water source and water treatment facilities;

- Accurate list of sources of suppliers of raw materials;

- Standard Operating procedures.

- Standard cleaning procedures (this involves the procedures and payment of the inspection fee as regards to bank draft of N130,000, which is payable to the Pharmacists Council of Nigeria.

Conclusion

Pharmaceutical businesses are so important since they provide more than potential cures and lifesaving treatments. In addition to this, they also make way for fulfilling jobs in the pharmaceutical industry, thereby fuelling the global economy.

For Pharmaceutical Company Setup, Feel Free to contact us

Tolulope Oguntade Regville Associates compliance@regville.com 08065111667