When starting a new business, one of the most important decisions that an entrepreneur will have to make is what type of legal entity to form. In the United States, two of the most popular options are the Delaware C-Corporation and the Delaware Limited Liability Company (LLC). Both of these legal structures have their own unique advantages and disadvantages, and the choice of entity will depend on the specific needs and goals of the business.

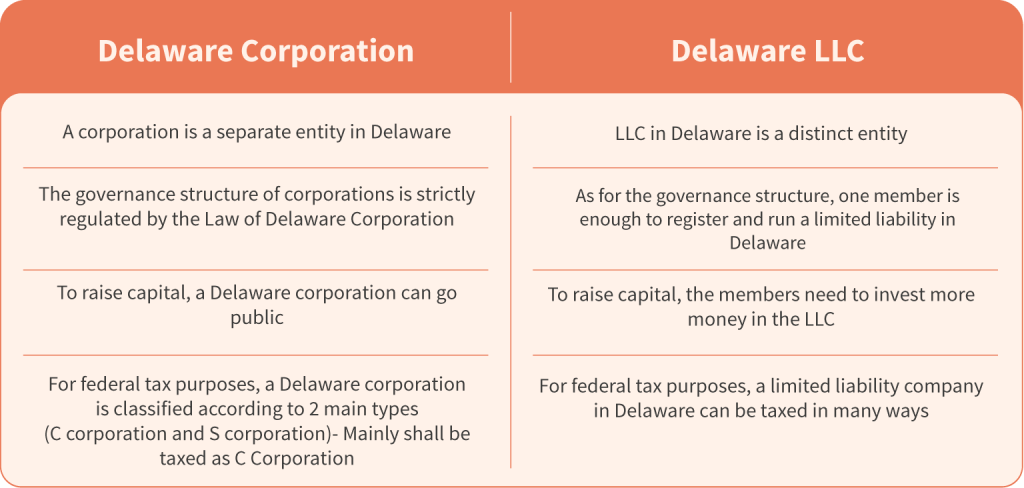

The Delaware C-Corporation is one of the most popular types of legal entities for startups, particularly in the technology industry. According to data from the National Venture Capital Association, 43% of venture-backed companies in the United States are structured as C-Corporations. One of the key advantages of a C-Corporation is that it offers limited liability protection for the company’s shareholders, which means that they are not personally liable for the company’s debts and obligations. Additionally, C-Corporations are taxed as separate entities, which allows for greater flexibility in terms of raising capital and issuing stock.

Another advantage of the C-Corporation is that it is well-suited for companies that plan to go public or be acquired by a larger company. This is because the stock structure of a C-Corporation is more flexible than that of an LLC, and it is easier to transfer ownership of a C-Corporation through the sale of stock.

However, there are also some disadvantages to forming a Delaware C-Corporation. One of the biggest drawbacks is the potential for double taxation. C-Corporations are subject to corporate income tax on their profits, and then shareholders are subject to individual income tax on any dividends that they receive. Additionally, C-Corporations have more extensive recordkeeping and reporting requirements than other types of legal entities.

On the other hand, the Delaware LLC is another popular option for entrepreneurs, particularly for those who are looking for a more flexible legal structure. According to data from the Small Business Administration, LLCs accounted for 57% of all new business formations in the United States in 2019. One of the key advantages of an LLC is that it offers pass-through taxation, which means that the business’s profits are only taxed once, at the individual level.

Another advantage of an LLC is that it offers more flexibility in terms of management and ownership structure. In an LLC, the owners are referred to as members, and they can choose to manage the business themselves or hire professional managers to do so. Additionally, LLCs do not have as many recordkeeping and reporting requirements as C-Corporations.

However, there are also some disadvantages to forming a Delaware LLC. One of the biggest drawbacks is that LLCs do not offer the same level of limited liability protection as C-Corporations. While the LLC does protect the personal assets of the members from business debts and obligations, they can still be held personally liable for their own actions or negligence.

In order to determine the best legal structure for a new business, entrepreneurs should carefully consider their specific goals and needs. For example, a tech startup that plans to raise venture capital and eventually go public may be better suited for a Delaware C-Corporation, while a small business that values flexibility and pass-through taxation may be better off forming an LLC.

In addition to considering the advantages and disadvantages of each legal structure, entrepreneurs should also take into account the costs of forming and maintaining the entity, as well as any legal and regulatory requirements that may apply.

Overall, the choice between a Delaware C-Corporation and an LLC will depend on the specific needs and goals of the business. While each structure has its own advantages and disadvantages, the right choice can provide the foundation for long-term success and growth.

Regville Associates offers end-to-end legal, tax and secretarial service for companies. We assist Companies in becoming and staying regulatory compliant.

Feel free to contact us.

Tolulope Oguntade Regville Associates info@regville.com 08065111667