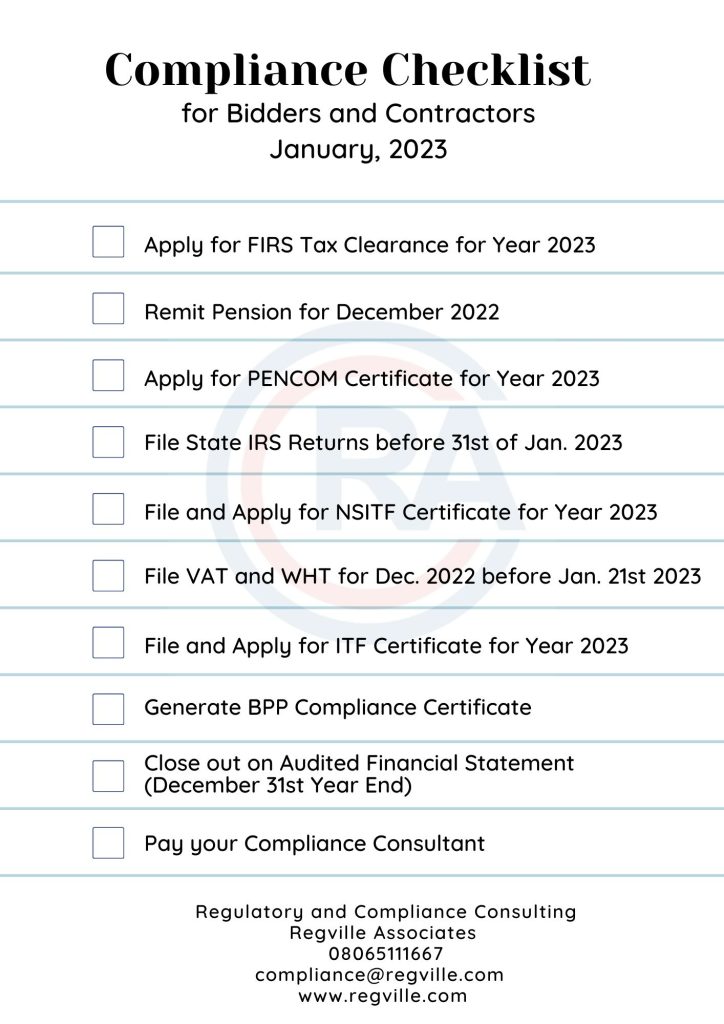

Compliance certificates are documents that show that a business is operating in accordance with the laws, regulations and standards set by the relevant authorities. In Nigeria, businesses are required to obtain a number of compliance certificates to demonstrate their compliance with the country’s laws and regulations this includes, a Tax Clearance Certificate (TCC) issued by the Federal Inland Revenue Service (FIRS), ITF Certificate issued by the Industrial Training Fund, NSITF Compliance Certificate issued by The Nigeria Social Insurance Trust Fund, PENCOM Certificate issued by The Pension Commission and Acknowledgement copies of payment of Annual Returns.

Here are five reasons why business owners need to have compliance certificates:

1. LEGAL COMPLIANCE: By obtaining compliance certificates, businesses demonstrate that they are operating within the law and that they are adhering to the standards and regulations set by the relevant authorities. This helps to reduce the risk of legal penalties and fines that may arise from non-compliance.

2. IMPROVED REPUTATION: Having compliance certificates can also help to enhance the reputation of a business. Customers and other stakeholders are more likely to trust a business that is in compliance with the law, which can translate into increased sales and a better bottom line.

3. ENHANCED COMPETITIVENESS: Obtaining compliance certificates can also give businesses a competitive edge over their competitors. By demonstrating their commitment to operating within the law and adhering to industry standards, businesses can differentiate themselves from those who are not in compliance.

4. ACCESS TO OPPORTUNITIES: Many businesses are required to have compliance certificates to participate in certain tenders or to enter into partnerships with other organizations. This means that by obtaining compliance certificates, businesses can gain access to new opportunities and markets that may not be available to those who are not in compliance.

5. PEACE OF MIND: Finally, having compliance certificates can provide peace of mind to business owners, as they know that they are operating within the law and that they are meeting the standards and regulations set by the relevant authorities. This can help to reduce the stress and anxiety that can arise from uncertainty and help business owners to focus on growing their businesses.

In conclusion, compliance certificates are an important part of doing business in Nigeria and can provide a number of benefits to business owners. By demonstrating their commitment to operating within the law and adhering to industry standards, businesses can reduce the risk of legal penalties, improve their reputation, enhance their competitiveness, gain access to new opportunities, and provide peace of mind to their owners.

Regville Associates offers end-to-end legal, tax and secretarial service for companies. We assist Companies in becoming and staying compliant.

We will be happy to hear from you.

Tolulope Oguntade Regville Associates info@regville.com 08065111667